File a complaint with Sebi against delistingOne problem of holding on to dud stocks is that you cannot claim losses under "capital gains" as it is neither a transfer nor a sale of shares or extinguishment of right. The depository participant can close your demat account only if you have zero balance and that is impossible as the companies have been delisted and you cannot sell or transfer the shares. It is possible to achieve zero balance if you rematerialise your shares, that is, re-convert to physical shares, but this option is no good either. As there is a high probability that the delisted company has disappeared, who will rematerialise your shares?

Which means you have to keep paying for holding on to the stocks and the demat account. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account."

Eligible shareholders may tender the equity shares through their respective stock brokers by indicating the details of the equity shares to be tendered under the delisting offer during the normal trading hours of secondary market. Those investors fail to participate in the reverse book-building process have the option of selling their shares to the promoters. The promoters are under an obligation to accept the shares at the same exit price. This facility is usually available for a period of at least one year from the date of closure of the delisting process.

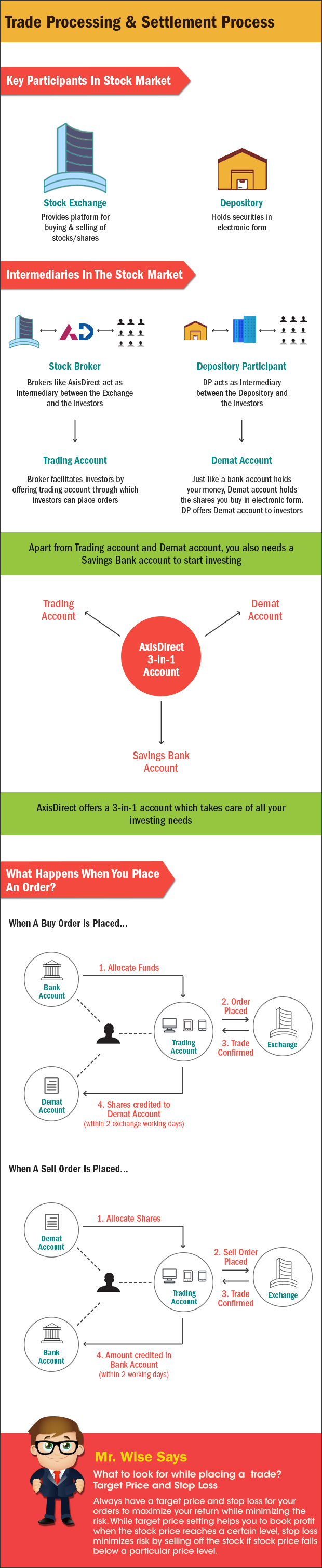

Stock can be bought and sold privately or on stock exchanges, and such transactions are typically heavily regulated by governments to prevent fraud, protect investors, and benefit the larger economy. The stocks are deposited with the depositories in the electronic format also known as Demat account. As new shares are issued by a company, the ownership and rights of existing shareholders are diluted in return for cash to sustain or grow the business. Companies can also buy back stock, which often lets investors recoup the initial investment plus capital gains from subsequent rises in stock price.

Stock options issued by many companies as part of employee compensation do not represent ownership, but represent the right to buy ownership at a future time at a specified price. This would represent a windfall to the employees if the option is exercised when the market price is higher than the promised price, since if they immediately sold the stock they would keep the difference . If you still have any physical share certificates, it is essential to convert them into dematerialised form with a depository. Dematerialisation is the process to convert physical shares of a company into electronic format.

However, the investors can convert physical shares of an active company and trading on the stock exchange. The investors cannot convert the physical share certificates of companies delisted from the stock exchanges into Demat form, and unfortunately, physically held shares are now non-saleable. The companies can get delisted from all stock exchanges following the substantial acquisition of shares. Company may upon request get voluntarily delisted from any stock exchange other than the regional stock exchange for the company, following the delisting guidelines. In such cases, the companies are required to get prior approval of the holders of the securities sought to be delisted, by a special resolution at a general meeting of the company. The shareholders will be provided with an exit opportunity by the promoters or those who are in the management control.

The shares are delisted formally only after the delisting process is approved of officially. From that point, a one-year exit window is offered to the residual shareholders to tender the shares they hold at a price fixed upon during delisting. The investors are given ample time to sell off their stocks.

If an investor chooses to keep the shares after the delisting, he or she will continue to enjoy legal ownership and rights over those shares. But shouldn't investors expect that a formal regulator and the listing process would involve greater scrutiny and action? Once the companies are delisted, investors will be stuck with worthless shares in their demat accounts and continue to pay annual charges to the depository participant to keep them there. There is no process to write them off and doing so also ends any chance to benefit, if the company chooses to re-list in the future.

Investors, who hung on to their shares post-delisting, made massive gains when the company came back with a large public offering and re-listed, when realty market boomed again. In the case of involuntary delisting, the delisted company, whole-time directors, promoters and group firms get debarred from accessing the securities market for 10 years from the date of compulsory delisting. Promoters of the delisted companies are required to purchase the shares from public shareholders as per the fair value determined by an independent valuer. Small companies that do not qualify and cannot meet the listing requirements of the major exchanges may be traded over-the-counter by an off-exchange mechanism in which trading occurs directly between parties. Shares of companies in bankruptcy proceedings are usually listed by these quotation services after the stock is delisted from an exchange.

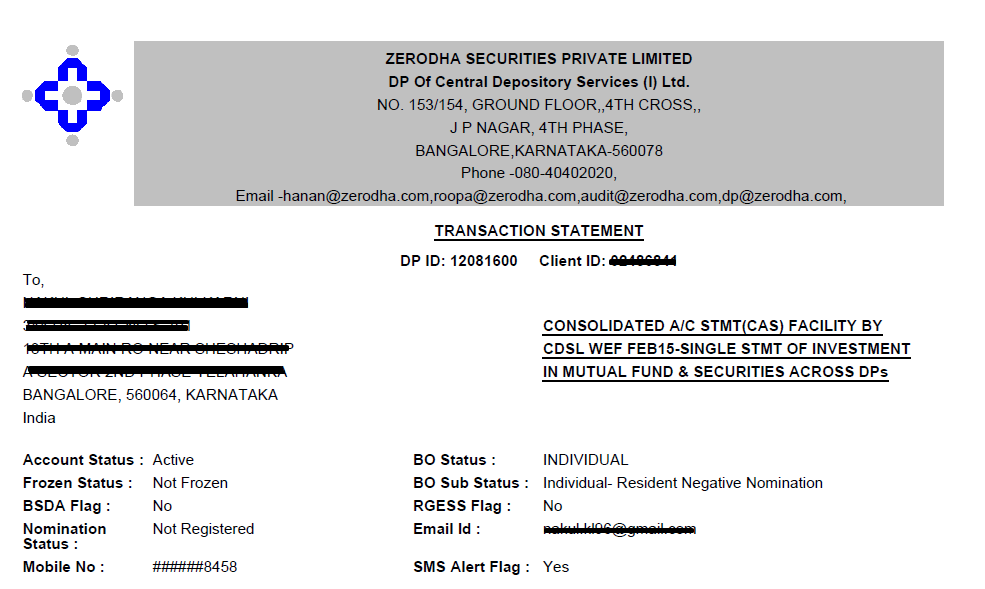

Demat account is just like a bank account that holds your shares or securities in an electronic form. The demat account can hold not only equities but also your investments in mutual funds, bonds, exchange-traded funds and government securities. Whenever you purchase any share from the stock market, it is done through the trading account. On T+2 days the shares get automatically credited into your demat account. When you want to buy shares in the secondary market i.e. directly from the stock exchange where the companies are listed, you will require a trading account.

Your buy trade will get executed through the trading account and the shares will get credited into your demat account on T+2 days. The process of shares getting transferred into your demat account is automatic. However, your broker may hold up the transferring of shares into your demat account if any payment is due from your end.

To be listed on a major stock exchange, such as NASDAQ or the New York Stock Exchange, a company must meet certain requirements, such as trading at a minimum share price and making financial disclosures promptly. Failure to meet these requirements results in the shares being delisted. If you own delisted shares, you can still sell them on the Over-the-Counter Bulletin Board or on the Pink Sheets, which have more relaxed regulations and few listing requirements. OTC trading is volatile, and this level of risk is typically not suitable for beginning investors. If you do have a loss, you can write it off on your taxes to decrease your tax liability.

If involuntary delisting occurs, the company that is delisted, its directors, group firms and promoters get prohibited from entering the securities market for a decade, as calculated from the date of the delisting. The promoters must purchase the shares held by public shareholders at a value that is fixed upon by an independent valuer. The desire of stockholders to trade their shares has led to the establishment of stock exchanges, organizations which provide marketplaces for trading shares and other derivatives and financial products. Today, stock traders are usually represented by a stockbroker who buys and sells shares of a wide range of companies on such exchanges. A company may list its shares on an exchange by meeting and maintaining the listing requirements of a particular stock exchange.

As is evident from the term, it means a listed company removing its shares, from trading on a stock exchange. To voluntary delist, a company normally offers shareholders, a premium to be price at which the shares are being traded on the exchange. So, delisting is the process by which a listed security is removed from the exchange on which it trades. In voluntary delisting, the process is considered to be successful only if the shareholding of the acquirer and the shares presented by public shareholders taken together makes up 90% of the company's total share capital. The company's promoter is not permitted to take part in this. The floor price is arrived at by using a reverse book building process.

The promoter of the company is not allowed to participate in the process and the floor price is decided based on a reverse book building process. As per SEBI delisting regulations, promoters of these delisted companies will be required to buy the shares from the public shareholders. The exit price will be as per the fair value determined by the independent valuer appointed by the BSE.

Neither the IOP nor the floor price is the final exit offer price for the Delisting Offer. The final exit offer price is determined pursuant to the reverse book building process prescribed in the Delisting Regulations. It would be decided on the basis of bidding by the Public Shareholders during the bidding period. If investors do not take part in the reverse book building process they still have the option to sell their shares back to promoters. The price here would be the same price exit price accepted from the reverse book building process.

The shareholders will be allowed to do this for one year from the date of closure of the delisting process. The merchant banker oversees the Reverse book building process. It is the process used by the company to set a price that is used to attract the investors into agreeing to the delisting. In this process, the shareholders bid online the prices at which they would be willing to sell the shares.

What Happens With Delisted Shares A long as the stock is traded in one of the exchanges that are made available to investors throughout the country it is considered as a listed stock. Anyways, if a company is listed in multiple stock exchanges in a country and decides to stop trading from just one of the exchanges, it is not considered as delisting. However, if it removes its shares from all the stock exchanges barring people to trade, then it is considered as delisting of shares. After the payment to all shareholders is completed, company must make final application to the Stock exchanges requesting for delisting of shares. Once the compliance department verifies that all requirements are met, the stock exchange will dispose the application and delist the shares.

Just as listing a stock makes it available for trading on a recognized stocks exchange, delisting is about removing the shares from the stock exchange and ceasing it to be traded in the share market. Mandatory delisting is enforced by the stock exchanges where the company has failed to comply with the listing agreement or where the public shareholding has gone below the threshold level. Involuntary delisting means the forced removal of a listed company's shares from the stock exchange. Involuntary delisting happens for several reasons such as when there is a violation of the regulations, late or wrongful reporting, or the failure to meet the minimum financial expectations, etc. Monetary standards refer to the ability to maintain the share price, financial ratios, and sales volumes at a requisite minimum. When a company fails to meet the listing requirements, the respective exchange issues a warning of non-compliance to the company.

If the issue remains unaddressed beyond specified timelines, the stock is delisted by the listing exchange. When a company comes out with an IPO issue, it means that it is not listed on the stock exchange and it wants to get listed by issuing fresh shares of the company to the public. The company may use the funds collected from IPO for any of its business activities like expansion, diversification, reducing debt, etc. As an investor you have to apply for the shares through an IPO application. When the allocation of IPO shares is complete, the shares will get credited into your demat account automatically.

There is no need for a trading account to purchase shares from the primary market. The reasons for delisting include violating regulations and failing to meet financial specifications set out by the stock exchange. Companies that are delisted are not necessarily bankrupt, and may continue trading over the counter. In order for a stock to be traded on an exchange, the company that issues the stock must meet the listing requirements set out by the exchange.

The listing requirements include minimum share prices, certain financial ratios, and minimum sales levels and so on. If the listing requirements are not met by a company, the exchange that list the company's stock will probably issue a warning of non-compliance to the company. If the company's failure to meet listing requirements continues, the exchange may delist the company's stock.

Despite the renewed focus on investor protection by regulators and stock exchanges, there are companies that continue to tap the market for funds and vanish without a trace or are struck off the exchange for violations. These delisted companies leave in their wake a trail of clueless investors who have been cheated out of a fair value of their investments. In such cases, the promoter decides the exit price in consultation with the merchant banker. The promoter writes to all public shareholders informing the proposal for delisting. Once the requisite consent is received, the promoter makes payment of consideration for the same and the shareholders can exit.

When a company wants to de-register its stocks from stock exchange and no longer wants to let public buy and sell its shares, then it's called delisting process. In most of the cases, the stock holders will get back the value of their shares on the price which is determined at the time of delisting. If the Delisting Offer is successful , the Equity Shares will be delisted from the Stock Exchanges and the Company will become an unlisted public company.

Prices of following delisted shares are indicative and subject to change. These shares are infrequently traded so we may not be able to provide you a deal even though price is displayed. We display the prices to update the current market trend to the investors. The actual prices may be at significant variance from what is stated on this website because we may err to judge the correct price of the mkt if we do not transact in any script, which happens for many scripts for several months. Therefore you are requested to call to find out the correct purchase price of following delisted shares. The investment banker is appointed by the company to manage the delisting.

The first step is to open an escrow account and deposit the estimated amount of consideration for buyback of shares calculated on the basis of floor price. The Floor price is the minimum price that shall be paid to the public shareholders. Deposit to Escrow account can be made in the form of cash or as bank guarantee. In 2010 the government made it compulsory for companies that are traded in the stock exchange to make at least 25% available to the public. This encouraged companies that had promoters owning more than 75% of the company to delist their securities. This caused investors to target companies where the promoters have ownership of 80-90%.

This was done in anticipation that the company will buy back the shares at a premium. Delisting refers to a listed company removing its shares from trading on a stock exchange platform. As a consequence of delisting, the securities of that company would no longer be traded at that stock exchange. Shares in physical form are semi-illiquid investments unlike dematerialized shares.

Some of those physical shares may not be traded over stock exchanges. We provide you the service of buying those illiquid physical shares at spot payment. Pre-IPO trading means buying/selling the shares of a company before it gets listed on the stock exchanges. Since these shares are not traded in the public market, you do not have a marketplace like stock exchange to buy it.

We are among the founder members of the unquoted stock market dealing in unquoted, delisted, illiquid shares in physical and demat form since 30 years. Our core expertise in identification of Pre-IPO companies like DLF, ISGEC, LUX Industries,etc proved to be multi-bagger for investors and shareholders. Share delisting is the removal of a listed stock from a stock exchange platform, and thus it would no longer be traded on the bourse. In simple words, delisting means the permanent removal of a stock from stock exchange.

The delisting of a security can be either voluntary or involuntary. In case of involuntary delisting, no opportunities are left for investors. Bankruptcies, failure to maintain the requirements set by the exchange, takeovers or mergers, stock performance are key factors that often lead to delisting. The balance of your demat account should be 'nil' if you want to close it. Kingfisher Airlines was delisted by NSE in 2018 and you will not be able to sell these shares at present and in future.